ETFs - the new game

- Bryan Teo

- Aug 27, 2018

- 4 min read

Exchange traded funds, or ETFs, have been increasingly growing in proliferation the past few years due to it's accessibility and unparalleled exposure mechanics. ETFs are fundamentally a basket of stocks which trade as a single stock, thus the simplicity. As such, there can be limitless amount of ETFs, in this post we will be focusing on regional index tracking ETFs.

Index-tracking ETFs have allowed investors to gain exposure to an entire region much easier compared to say a decade ago, when global asset allocation is rather unwieldy and costly for an average retail investor. With ETFs, one can simply purchase a ETF stock and immediately gain (almost full) exposure to a region's market. This would result in far less asymmetric risks and costs.

While there exists larger scale regions such as global equities, asia-pacific equities, whole market ETF's, these are a little redundant as it defeats the purpose of asset rotation among different regions.

Rather, the 'regions' that I am personally interested in are USA, Europe, China/Hongkong, India and Singapore. One might realize that several key players or regions are missing from the list, such as Vietnam, Malaysia, Thailand, etc. These are excluded due to the fact that most of them are grouped under emerging markets or frontier markets ETFs, and these country-specific ETFs are rather small and are consequently costly and too illiquid to invest in. Performance wise, one can easily replicate the growth of the markets with the aforementioned ETFs.

The list below gives a short description about the various regions that one might be interested in.

USA exposure ETFs

These are the ETFs that tracks the S&P 500 index and the Dow Jones Industrial Index respectively. They mainly hold large-cap American stocks such as Goldman Sachs, Facebook, Microsoft etc.

1. SPDR S&P 500 ETF Trust

Trades on the US market, Ticker: SPY

https://www.spdrs.com.sg/etf/fund/spdr-sp-500-etf-S27.html

2. SPDR Dow Jones Industrial Average ETF

Trades on the US market, Ticker: DIA

https://www.spdrs.com.sg/etf/fund/spdr-dow-jones-industrial-average-etf-D07.html

China/ HK exposure ETFs

1. iShares MSCI China ETF

Trades on the US market, Ticker : MCHI

https://www.ishares.com/us/products/239619/ishares-msci-china-etf

This ETF holds mainly large-cap China stocks such as TENCENT, ALIBABA, China construction bank, Baidu, etc.

2. iShares MSCI Hong Kong ETF

Trades on the US market, Ticker : EWH

https://www.ishares.com/us/products/239657/ishares-msci-hong-kong-etf

This ETF tracks a market-cap-weighted index of firms listed on the Hong Kong Stock Exchange. It holds mainly large-cap Hongkong-listed stocks such as AIA group, HKEx, Hang seng Bank, BOC HK etc.

Europe exposure ETFs

1. Vanguard FTSE Europe ETF

Trades on the US market, Ticker : VGK

https://investor.vanguard.com/etf/profile/VGK

This ETF track the performance of the FTSE Developed Europe All Cap Index, which measures the investment return of stocks issued by companies located in the major markets of Europe. It holds mainly large-cap European stocks such as Royal Dutch Shell, Nestle, HSBC, Novartis, BP, etc.

India exposure ETFs

1. iShares MSCI India ETF

Trades on the US market, Ticker : INDA

https://investor.vanguard.com/etf/profile/VGK

This ETF holds mainly large-cap Indian stocks such as Reliance, Infosys, Housing development finance corp etc.

Singapore exposure ETFs

1. SPDR Straits Times Index ETF

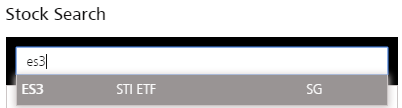

Trades on the SG market, Ticker : ES3

https://www.spdrs.com.sg/etf/fund/spdr-straits-times-index-etf-ES3.html

2. Nikko AM Singapore STI ETF

Trades on the SG market, Ticker : G3B

https://www.nikkoam.com.sg/etf/sti

These ETFs tracks the Strait Times Index and holds mainly large-cap Singaporean stocks such as DBS, OCBC, UOB, Singtel, Keppel etc.

One can simply invest in the ETF the way one purchase any stock, as they are simply registered under a different ticker, as such.

*Note* You might require access to the US market (ARCA/NYSE/NASDAQ) before you can purchase most of the ETFs outside Singapore, as they are mainly listed and traded in the American exchanges. Most brokers in Singapore will have easy access to the US market by simply signing a few more forms, and the platform to purchase would be similar, if not already available. These will be denominated in USD and thus if you do not have USD available, SGD will be used to convert to USD at the bank's prevailing rate. Which is not so good... but you would be fine if you are holding for long periods

There are lots of other ETFs available such as technology stocks ETF, industrial stocks ETF, commodities stocks ETF and even inverse-index ETFs but these are out of the scope of the article and not really needed for the ordinary investor looking to make safe and stable returns over a longer period but feel free to explore.

**Hereinafter are personal views and as such not meant to be educational or definitive, do your own due diligence!

The few markets mentioned above makes up nearly the entire world's equity share, save a few small markets, and as such it would make sense that money would more or less rotate around these regions in normal economic times. Should there be a financial crisis, definitely money would be flowing out of equities and all regions would take a hit, one can hedge against that by purchasing bonds and commodity ETFs.

However, assuming nothing apocalyptic happens, one can easily allocate funds into a region that might be discounted due to a one-off or recoverable incident, such as Europe, as of writing. Europe ETF have provided investors with a few opportunities with Brexit, Greece crisis, Italy crisis, and the more recent Turkey crisis. With them joining in the trade war, European equities would be an attractive long now.

The Chinese market also took a hit from the 2015 crisis, falling about 50% from it's peak and is only slowly recovering and stabilizing. While the ongoing trade war might hamper it's recovery or even push it down further, it does show up as an attractive purchase right now as moody investors sentiment tend to lighten up sooner or later.

Cheers and safe investing!

Comments